It felt obvious: swap a UK pension for Portugal’s sun and never look back. What I found was bright and gentle, yes, but also pricier, lonelier and stickier than the brochure promised.

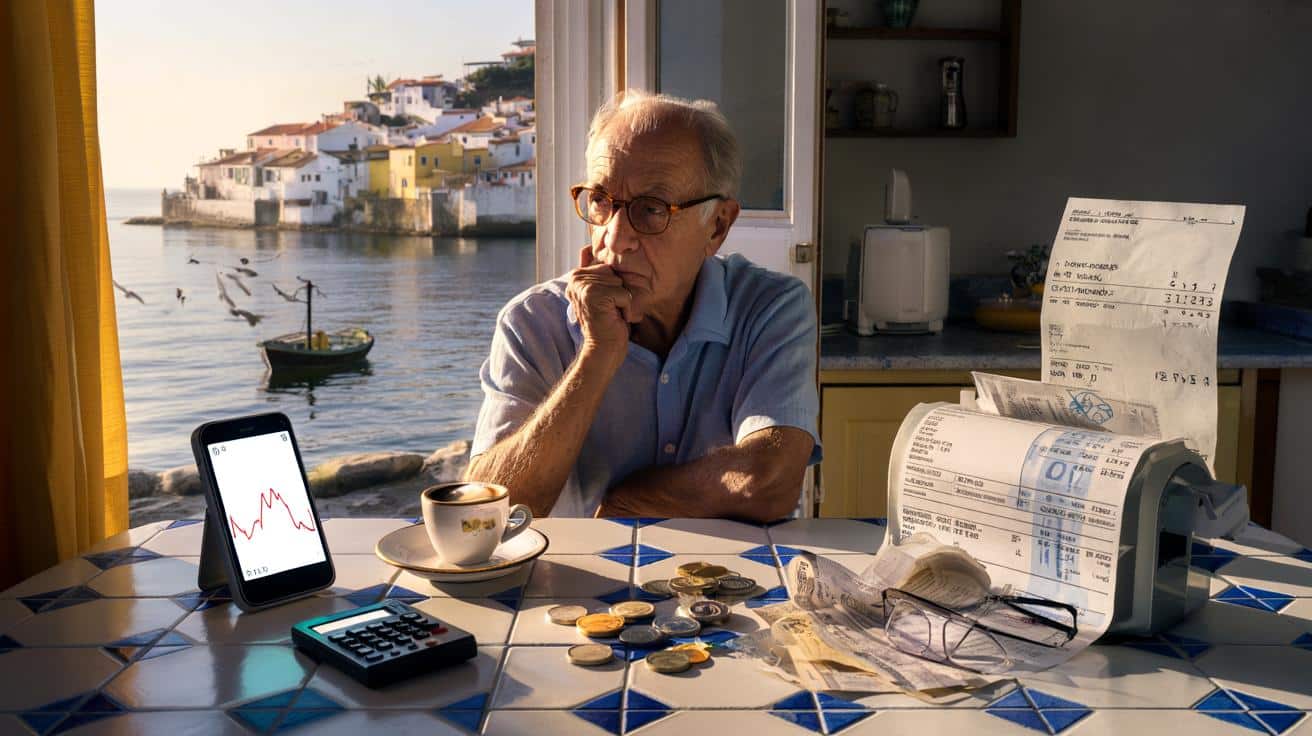

The old man at the kiosk pressed my bica into my hand at 7:42am, steam threading the air like a ribbon. A fishing boat groaned into Lagos harbour, gulls heckling the morning, and my phone lit up with another alert: GBP/EUR nudging the wrong way again. I checked the supermarket receipt from yesterday — olive oil up, butter up, electricity still biting — as the postie slipped a bill from Finanças under the door. *I thought sun would fix everything.* We’ve all had that moment when the fantasy and the figures meet. Then the bill arrived.

The postcard and the price tag

Portugal is gorgeous in a way that makes you soften. Afternoons stretch, neighbours wave, and the sea makes a believer of you. The trouble sneaks in quietly. Exchange rates nibble your pension, winter energy bills spike in houses built for summer, and eating out like you’re on holiday melts a budget fast. The first year, I lived like a guest. The second, I learned the difference between moving and staying.

Take John and Maureen from Kent, who landed in Tavira full of vim and spreadsheets. They rented a bright two-bed, walked the salt pans at dusk, and paid for everything on a UK debit card because it “felt simpler”. Three months in, the landlord nudged the rent, sterling slid a bit, and their winter bill arrived from running two little heaters. That £300 they’d saved on flights started to look like a rounding error. “It’s still lovely,” John told me, “just not the bargain we’d bragged about.”

The maths is not complicated, but it hides in plain sight. Your pension is in pounds; your life here is in euros. A small wobble in the rate can eat a week’s groceries or the council tax equivalent. Tax rules have shifted too, with special regimes fading and new incentives knit to specific professions and criteria. UK state pensions are generally taxed where you live, while some government pensions stick to the UK. The dream stands — it just needs a sturdier frame.

What I wish I’d done before the one-way ticket

Build a 12‑month test budget in euros, not pounds, with a buffer that makes you wince. Price rent in winter, not July. Track every receipt for a fortnight — market veg, pharmacy bits, taxis when it rains sideways — then multiply and add 20% for the unknowns. Try a 60–90 day stay out of season and live like a local: cook at home, use public clinics, take the bus, and practice waiting at the town hall. It’s a rehearsal, not a holiday.

There are gentle traps. Buying a car before you know if you’ll need it. Falling for a damp stone charmer because the tiles are pretty. Ignoring Portuguese classes because “everyone speaks English”. Let’s be honest: nobody really does that every day. Start routines small — a Thursday café, a language swap, a swim club — and let community grow in the gaps. Loneliness here feels strange under a blue sky, and it doesn’t show up on a budget sheet.

There’s also the admin. Residency, tax numbers, health cover, banking — all doable, all slower than you think. The trick is to expect the slow and bake it into your mood. Paperwork purgatory ends, but only if you show up with patience and copies of everything.

“Portugal is easy to love and hard to understand. Give it time and it gives back.” — a clerk in my local Finanças, after we both laughed at my third attempt

- Scan and print: passport, NIF, residency card, rental contract, utilities, pension letters.

- Open a local bank and set euro direct debits for utilities and rent.

- If eligible, register an S1 for healthcare; if not, price private cover early.

- Track the GBP/EUR rate and use alerts; batch transfers when it’s in your favour.

- Keep a “waiting fund” for deposits, stamps, and trips to offices that close for lunch.

The sweet middle ground I finally found

Year two, I stopped chasing the postcard. I swapped beach lunches for market fish at home, learned which baker closes on Mondays, and found out the cheapest warmth is a well-placed rug and a dehumidifier. I made friends the slow way — volunteering at the library, cheering at the local futsal, fumbling my Portuguese in public. Sun-soaked fantasy became ordinary light on ordinary days, which turned out to be what I was really seeking. The money still matters. The trade-offs are still real. Yet when the wind lifts across the estuary at dusk and the church bells step out of time, I remember why I came. A sustainable life beats a perfect one.

| Point clé | Détail | Intérêt pour le lecteur |

|---|---|---|

| Cost reality | Budget in euros with a winter-first lens and a 20% buffer | Avoids nasty surprises from exchange rates and seasonal bills |

| Admin rhythm | Copies, patience, and local banking smooth residency and bills | Reduces stress and wasted trips to offices |

| Life, not holiday | Build routines, learn basics of Portuguese, and limit “treat days” | Creates belonging while protecting your pension |

FAQ :

- How are UK pensions taxed if I live in Portugal?For most retirees who are tax resident in Portugal, private and state pensions are taxed in Portugal under the UK–Portugal treaty, while certain UK government service pensions remain taxable in the UK. The details depend on your mix of pensions and your residency status, so get personalised advice before you move money.

- Is healthcare free for UK retirees in Portugal?If you receive a UK State Pension, you can often use an S1 form to access the public system (SNS) once resident. Many expats still keep a modest private policy or pay as they go for speed and English-speaking clinics, especially for dental and diagnostics.

- What does a realistic monthly budget look like?Outside Lisbon/Porto, a modest life for a couple renting a two-bed might run €1,800–€2,600: rent €800–€1,200, groceries €300–€450, utilities and internet €150–€250, transport €80–€200, eating out and extras €200–€400. Add more for coastal hotspots or if you drive a lot.

- Can I bring my UK car and licence?You can drive on a valid UK licence for a limited period after residency, then switch to a Portuguese one. Importing a UK car post‑Brexit can trigger customs and registration taxes (ISV), and paperwork. Many people sell in the UK and buy locally to keep it simple.

- Will I feel isolated if I don’t speak Portuguese?Plenty of locals speak some English, but life opens up when you try. A weekly class, small phrases at shops, and joining local clubs change everything. Quiet, relentless costs are one thing; quiet, relentless isolation is another — language helps with both.

Thank you for the unvarnished view. We almost jumped after a sunny week in Lagos; your ‘rehearsal, not a holiday’ advice definitley saved us money—and probably stress.

Is it realy more expensive overall or just different? In my sums, council tax and winter gas in the UK are brutal. Curious if your net montly spend in year two actually fell.